From 0.01 to 510,000 Bitcoins in 365 Days – End of Week 1

TL;DR;

I’m trying to grow 0.01 worth of BTC by 5% per day for 365 days.

Today is the end of week one. (View last weeks blog)

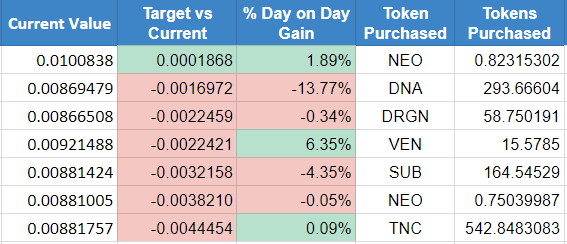

I am down 10.91%. My starting amount of 0.009897 is sitting at ~0.00881757

Track progress here.

Snapshot of week one

Oh hai there

Last week I paraphrased that “95% of day traders lose money, about 5% of traders make money, and only about 1% of traders make money consistently.” Without any sense of self-delusion, I’m clearly in the 95% bracket (and probably towards the bottom of it).

According to coinmarketcap, last week, the whole market had declined ~15.10%. But losing at a lower rate than the market is not the goal and not something I should pat myself on the back for. Especially since the goal was to increase the BTC holdings, which would have remained the same if I did nothing.

Strategies

I had no strategy. I did however watch a few datadash videos in the past, which always boiled down to “buy the dip” and “I never like to buy at all time highs”. Seemed like a winning strategy, so I thought I’d wing it and see how I go.

Day 1 was good. Day 2 was not so good, seemed like the dip wanted to double dip.

On day 2 or 3 I was watching a Suppoman live stream in the shower (it’s the only free time I have these days). I couldn’t hear exactly what he was saying, but he mentioned something about Bollinger and that it somehow helped him make better trading decisions. I looked into it – and it seemed like a really helpful analysis tool.

I had short listed some buying opportunities based on where the tokens sat within the Bollinger bands. The idea was good. My first trade wasn’t great, but my next trade was.

XRB: A token I passed to buy Dragon Chain (I lost money on DRGN, which bounced back strongly after I sold it)

On the weekend, I ended up going to the country. I was on the road, to places with poor reception and no Bollinger bands. So I was back to shoot in the dark.

Feedback from /r/cryptocurrency

I had overwhelming positive feedback on this experiment (anything outside the cryptoverse usually sees me getting down voted for recommending Bitcoin). Thank you to everyone for all your positive wishes. Here are great pieces of advice/feedback I received:

” I think bots and whales push down price to stop loss hunt which means even setting SL is risky. […] Overall, I think accomplishing this, if possible, would boil down to incredible almost unreal luck.” – I_am_Jax_account

Unfortunately, the exchange I’m using doesn’t offer stop-loss functionality. And I completely agree, that an incredible amount of luck would need to play a role.

“Good luck! As someone who has done a bit of trading over the last year I will tell you that the more BTC you have, the harder it becomes to make a 5% increase.” – Westthewolf

Unfortunately, I’m far away from this 1st-class problem.

“Make sure you use safe trading techniques. Scale in and out. Be certain of your trades. Don’t emotionally buy. Going all in our all out might set you back several days if you have one bad trade. It will get harder when you have more money. At the beginning, when it’s just chump change, you’ll control emotions more” – Azntigerlion

Very good advice. It’s something I need to look into more carefully. I believe on my VEN trades, I added scaled out sell orders, which helped me lock in a positive position. On my second NEO purchase, I missed my whole sell order by a small fraction and missed out on 2-3% gain (if I had scaled out), to making a very marginal loss.

“Good luck. Don’t start chasing losses, just move on and forget about it. Even if you make it to .5 BTC you’ve done an awesome job. I’ll keep checking your progress.” – hamster3rs

The emotional aspect of playing with even this small amount of money is interesting. After taking the first big loss (just by the end of day two!)… Did make me think more carefully about the purchases. But I do move on quickly 😉

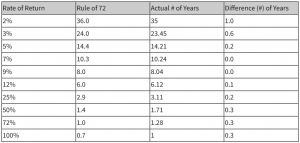

Averaging 5% per day would be astoundingly good. Rule of 72 will have you doubling your money every 2 weeks at that rate. I recommend you stick to your stop losses and not get greedy. – Bootstrapbuyout

This is the first time I had learnt of rule of 72. Thank you for sharing!

I try and sell out at 5% (but I don’t usually get there!). I’ll try and incorporate more of hamster3rs advice.

Rule of 72

What will I do differently for week 2?

Be the monkey

I heard somewhere anecdotally, that monkey’s outperform most traders on the share market.

This week (time permitting), I will be the monkey.

I will try and find a small selection of tokens that look good on the Bollinger bands, and picks one at random out of a hat.

Scale out sell order

I will place multiple sell orders at different prices to lock in some gains (even if it’s not the full 5%).

Buy slowly

Early on, I bought at whatever the selling prices was. This sometimes left a margin of 1-2% between selling and asking price. This week, I will try not to rush into a buy… and wait a little to see if I get a better price.

Until next time, I wish you all nothing but green days.

EDIT: feel free to provide your feedback here or send me your buy recommendations for the day @DennisGraham7 (my BTC is currently on Kucoin)

Dennis Graham is a seasoned finance professional working within Banking, Lending and Novated Leasing. An expert finance writer, Dennis combines industry insights with clear communication to deliver insights into financial products.

Latest posts

What You Should Know: Comprehensive vs. Third Party Car Insurance.

28.07.2020

What You Need to get a Mortgage in Australia

11.04.2019

What is a term deposit and how does it work?

04.06.2018